This Medigap Secret Could Save {state} Seniors Thousands!

This Medigap Secret Could Save Seniors Thousands!

Last Updated:

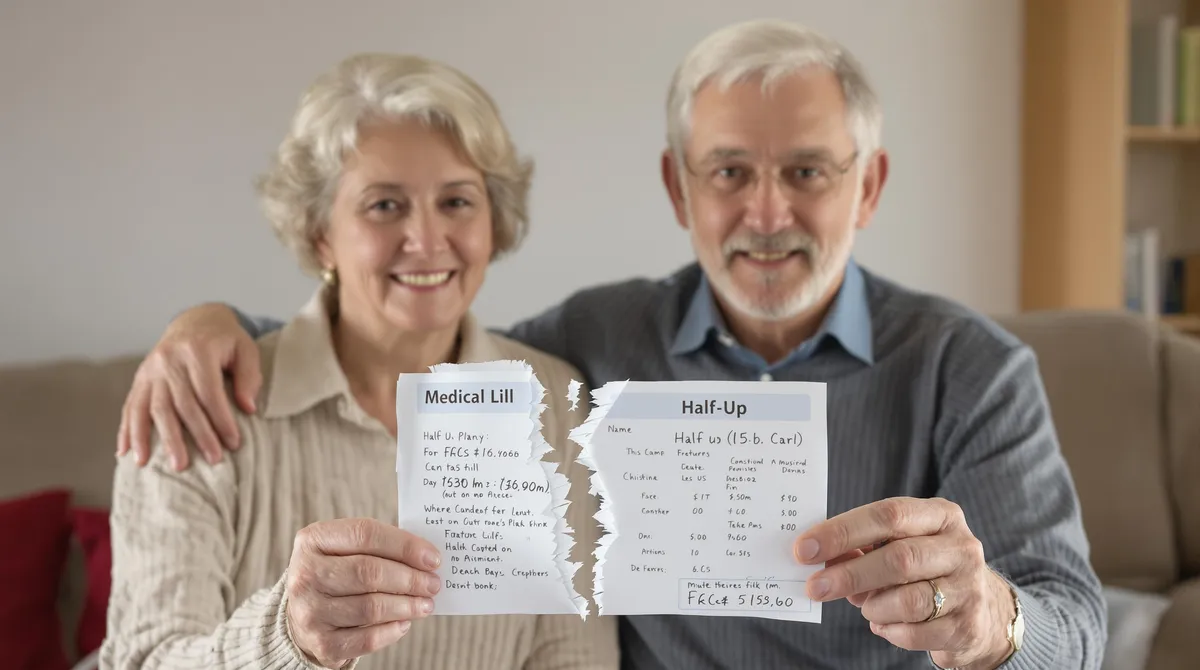

Imagine this: You’re a {state} senior, sipping coffee on your porch, when a medical bill lands in your mailbox. It’s $5,700—your out-of-pocket costs for the year. That’s the average hit seniors take without the right protection. Now imagine slashing that number, maybe even to zero, with one smart move. That’s the power of Medigap, and a new service called Quick Medigap is making it easier than ever for Texans to unlock these savings.

The Medigap Advantage: Your Shield Against Rising Costs

If you’re on Medicare, you already know it’s not the whole story. Original Medicare (Parts A and B) covers a lot—but not everything. Deductibles, copays, and coinsurance? Those are on you. In 2025, the Part B deductible alone is $257, and after that, you’re still footing 20% of every doctor’s visit or procedure. For a hospital stay or serious illness, those costs can skyrocket fast.

Medigap is a compliment to Medicare that helps to fill those gaps. You can use this free service to review your options and eligibility. Plans like G and N can cover your Part A hospital deductibles ($1,632 per benefit period in 2025), Part B coinsurance, and even emergency care abroad (up to 80% after a deductible). The catch? You need to be enrolled in Original Medicare (not Medicare Advantage) to qualify. But here’s the kicker: the right Medigap plan could save you thousands annually, and {state} seniors are catching on.

Why Quick Medigap Is Turning Heads With 10 standardized Medigap plans available in {state} (labeled A through N, though C and F are only for those Medicare-eligible before 2020), picking the perfect one feels like finding a needle in a haystack. Prices vary wildly between insurers—Plan G might cost $109 a month with one company and $184 with another, even though the benefits are identical. That’s where Quick Medigap steps in.

Quick Medigap isn’t an insurer—it’s a free service that connects you with top-tier insurance agents who compare plans from dozens of trusted carriers like Mutual of Omaha, Cigna, and AARP/UnitedHealthcare. They cut through the noise, showing you side-by-side options tailored to your budget and health needs. No guesswork. No overwhelm. Just clarity—and potentially huge savings.

The One Rule You Can’t Skip Here’s the golden nugget: Compare before you commit. Medigap plans are standardized by the federal government—Plan G is Plan G, no matter who sells it. The difference is the price, and it can swing by hundreds of dollars a year. Quick Medigap makes comparing a breeze, pulling quotes from multiple carriers so you don’t overpay. Skip this step, and you’re leaving money on the table.

{state} Twist: Timing Matters Your best shot at the lowest rates and guaranteed coverage is during your Medigap Open Enrollment Period—six months starting the day your Medicare Part B kicks in (usually at 65). During this window, insurers can’t deny you or charge more for pre-existing conditions. Miss it, and you might face medical underwriting, higher premiums, or even rejection—unless you qualify for a special guaranteed-issue situation, like losing employer coverage. Quick Medigap helps you navigate this, fast.

What’s the Cost—and What’s Covered? Medigap isn’t free—you’ll pay a monthly premium on top of your Part B premium ($185 in 2025 for most). But the tradeoff is peace of mind. Plan G, the most popular in Texas, averages $144 a month for a 65-year-old nonsmoker and covers nearly all Medicare gaps except the Part B deductible. Plan N, at $99-$109, trades a few small copays for a lower premium. High-deductible options (like Plan G at $46 a month) can save even more if you’re healthy now but want protection later.

Rates above are just estimates and you need to review your options with a licesned insurance agent in order to get a finalized quote.

Act Now—Here’s How Ready to stop overpaying? Quick Medigap makes it dead simple:

- Find your ZIP code below or click here to review personalized options.

- Answer a few quick questions about your needs.

- Review your options with a licensed agent—no pressure, just facts.

{state} seniors are already saving big—over 940,000 had Medigap in 2022, and that number’s climbing. Don’t wait for the next bill to blindside you. Tap below and see how much you could keep in your pocket.