How Medigap Could Help Fill the Gaps in Your Medicare Coverage

How Medigap Could Help Fill the Gaps in Your Medicare Coverage

Last Updated:

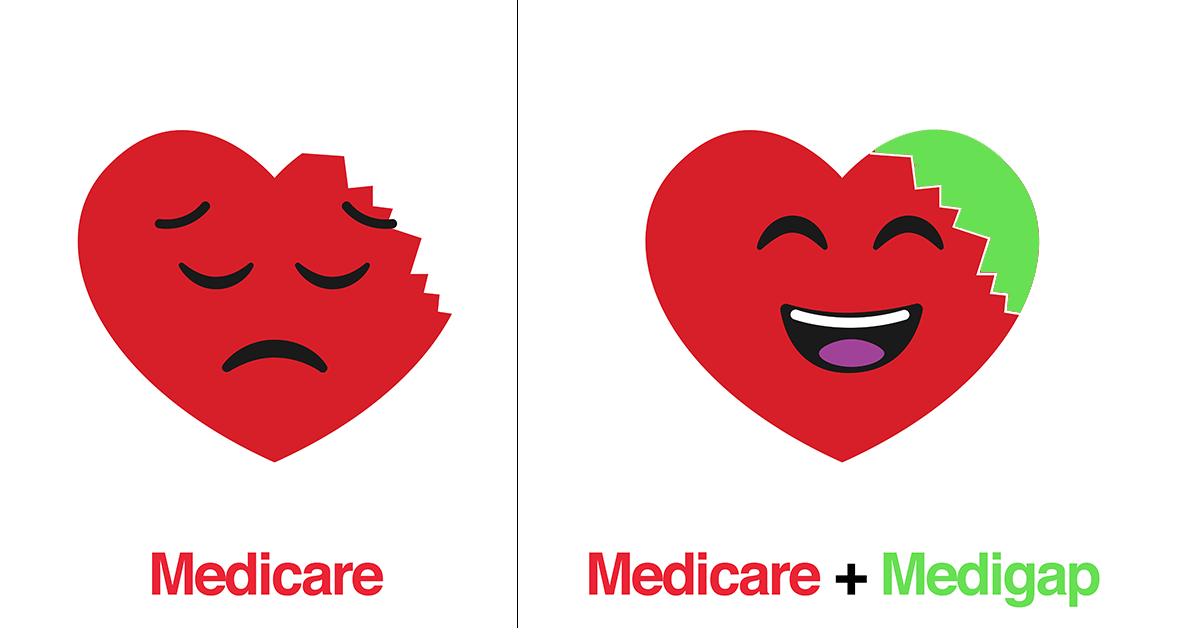

Are you approaching 65 or already enrolled in Medicare? If so, you’ve likely noticed that Original Medicare (Parts A and B) doesn’t cover everything—think copayments, coinsurance, and deductibles. Those costs can pile up fast. That’s where Medigap comes in—a supplemental insurance option designed to help cover what Medicare leaves behind. Curious about your options? Click here to review your Medigap options by answering a few quick, anonymous questions—no commitment required!

Why Consider Medigap? Original Medicare covers a lot, but not all. In 2025, Part A has a $1,676 deductible per benefit period, and Part B covers just 80% of approved outpatient costs after its deductible. Medigap can help bridge that gap, offering financial predictability when health surprises pop up. Plus, it’s accepted anywhere Medicare is—no network hassles, even when you travel.

What Is Medigap, Exactly? Medigap, or Medicare Supplement Insurance, is sold by insurance companies to work alongside Original Medicare. It’s not a replacement but a way to manage out-of-pocket costs. Depending on the plan, Medigap can help with:

- Hospital deductibles

- Doctor visit copays

- Skilled nursing facility coinsurance

With 10 standardized plans (A through N), you can choose the coverage that fits your life. Want to see what’s available in your area? Get a free quote now—just answer a few simple questions, and we’ll show you select companies ready to help.

Ready to explore your Medigap options? Click here for a free quote and review plans tailored to you in minutes.

Things to Know Before You Enroll Timing is key. Your Medigap Open Enrollment Period starts the month you turn 65 and enroll in Part B, lasting six months. During this time, insurers can’t deny you or charge more for pre-existing conditions. Miss it, and premiums could rise—or coverage could be harder to get—based on your health and state rules.

Premiums vary too, typically $50 to $300+ monthly, depending on your plan and location. Want to compare costs where you live? Get your free Medigap quote today—answer a few anonymous questions, and we’ll connect you with local options.

Is Medigap Right for You? It’s a personal choice. If you value predictable costs and don’t mind a monthly premium for extra coverage, Medigap could be a game-changer. But if you’re set with Original Medicare or prefer Medicare Advantage (which doesn’t pair with Medigap), it might not suit you.

Not sure where to start? Click here to get a free quote—takes just a minute, and you’ll see plans from select companies in your area after a few quick questions. No pressure, just info!

How It Works Getting a quote is easy:

- Click here to start.

- Answer a few anonymous questions (like your age and ZIP code).

- See a list of Medigap companies in your area ready to finalize your coverage.

For official details, visit Medicare.gov—but for a fast, free look at your options, get your quote now!