A New Medigap Plan In {state} May Save Seniors Thousands

A New Medigap Plan May Save Seniors Thousands

Last Updated:

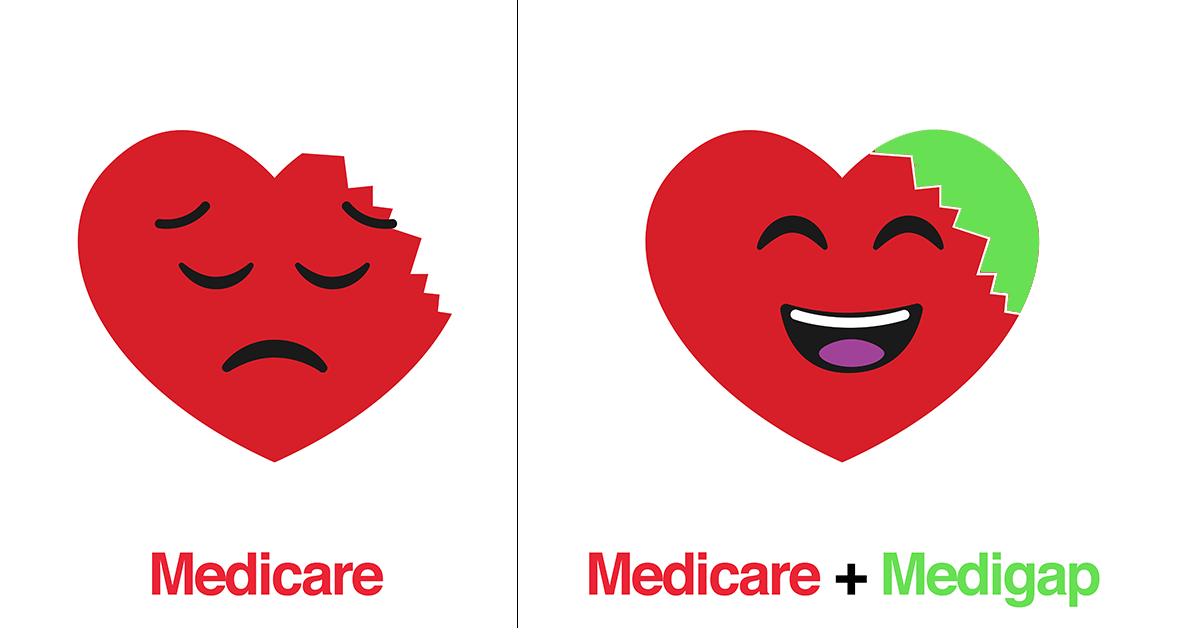

Seniors are averaging more than $5,700 per year on out of pocket medical expenses – but Quick Medigap aims to help change that.

Are you aware that your deductibles and co-pays could be covered with a Medigap plan? Get help with these special plans in qualified zip codes (Check the list below)

Thanks to Quick Medigap, you can start the process online and then review your Medigap eligibility and options.

What exactly do you need to do? Here is one easy rule to follow.

You have to compare plans. You probably shouldn't consider enrolling in a Medigap plan without doing this first. Plans are standardized by the government as to what coverages they offer, and the key is to make sure you review pricing for the plan type you want. With Quick Medigap, comparing plans is a breeze. Their network of top insurance agents have access to compare plans across many top carriers.

Seniors in {state} don’t always realize that they may be able to save on a big portion their medical expenses by enrolling in a good Medigap plan. This is because the information isn't always easy to find, and also because many seniors are presented with so many different plans. Fortunately, a lot of smart seniors out there figured out how to enroll in the right plan using Quick Medigap free service to find the perfect plan.

It’s really no wonder that with so many seniors saving money on their medical expenses, Quick Medigap is gaining momentum. Quick Medigap is an efficient source that tries to give consumers access to the Medigap plans that have the desired coverage at the lowest prices.

See If You Are Eligible:

- Step 1: Simply tap your zip below

- Step 2: Answer some basic questions and then review your available options

We work in the below zip codes.